Small Business Tax 2024 – Proponents of Measure C say it’s a way for major corporations to pay their fair share, but small business owners worry that the devil is in the details and that their already thin margins could be . Small businesses can lower their tax liability by taking advantage of tax breaks, tax credits and charitable donations. Here are some options. .

Small Business Tax 2024

Source : www.freshbooks.comSmall Business Operation Archives Grass Roots Taxes

Source : grassrootstaxes.comAmazon.com: J.K. Lasser’s Small Business Taxes 2024: Your Complete

Source : www.amazon.comJ.K. Lasser’s Small Business Taxes 2024: Author’s Overview

Source : bigideasforsmallbusiness.com5 Ways New Tax Changes Could Affect Small Business Owners in 2024

Source : www.inc.com2024 BECU Small Business Tax Strategy Seminar Woodinville Chamber

Source : woodinvillechamber.org2024 Inflation Adjusted Tax Parameters for Small Businesses and

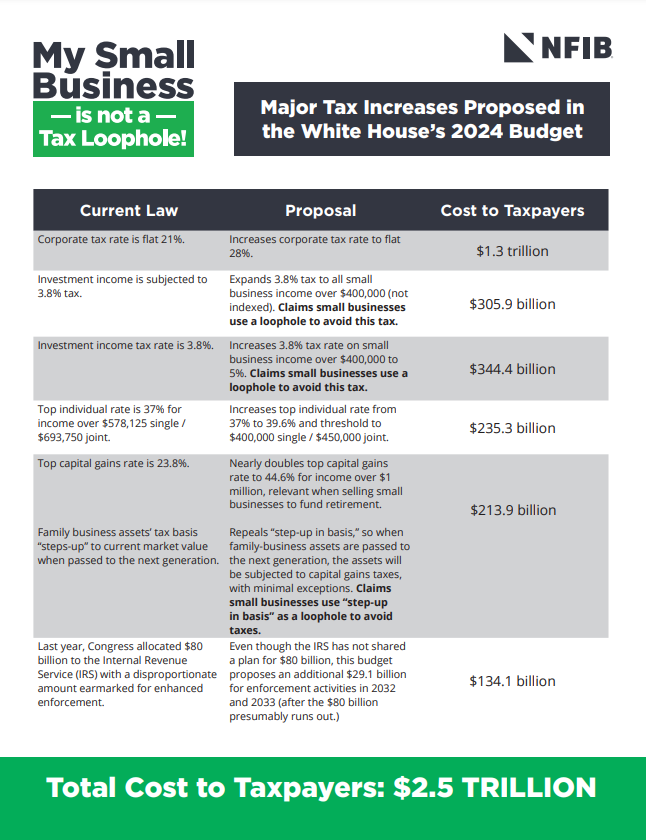

Source : dwcadvisors.comStop the Senate’s New Small Business Tax | NFIB

Source : www.nfib.comKey 2024 Inflation adjusted Tax Parameters For Small Businesses

Source : www.yeoandyeo.com2024 Tax Facts Individuals & Small Business

Source : www.nationalunderwriter.comSmall Business Tax 2024 25 Small Business Tax Deductions To Know in 2024: which is the standard tax-filing deadline. The upside of being a small business owner from a tax perspective is that you get to deduct certain costs associated with earning a living. However . Financial planning, tax planning and consulting are among the many services benefits and perks that are often not accessible to small business owners. Among U.S. workers actively seeking new .

]]>