Irs Schedule 1 Instructions 2024 2025 Federal – Making estimated tax payments is important since the U.S. tax system operates on a “pay-as-you-go” basis. This means the IRS expects you to pay a portion of your income as soon as you earn it. . The IRS designated January 26 Earned Income Tax Awareness Day in an effort to get more people to understand what it’s about. The IRS says that one in five taxpayers eligible for Earned Income Tax .

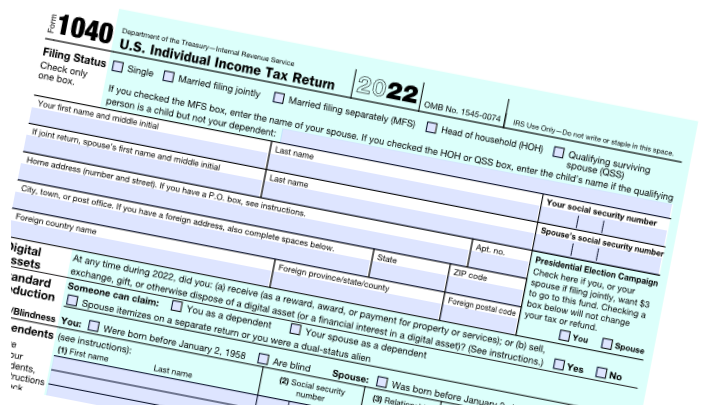

Irs Schedule 1 Instructions 2024 2025 Federal

Source : www.irs.gov7 Key Changes Coming to the 2024–25 FAFSA® Experience – Federal

Source : studentaid.gov1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govTax season is under way. Here are some tips to navigate it. – WAVY.com

Source : www.wavy.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govIRS Plans to Go Paperless by 2025 Tax Season CPA Practice Advisor

Source : www.cpapracticeadvisor.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govFinancial Aid | Mitchell Technical College

Source : www.mitchelltech.eduIrs Schedule 1 Instructions 2024 2025 Federal 1040 (2023) | Internal Revenue Service: Related: The Most Popular Tax Deduction Just Got Bigger for This Year’s Return The federal tax when you file your 2024 tax return, which won’t be due until April 2025. However, you can . Remember: You file 2023 taxes in 2024 and 2024 taxes in 2025 2-3. Internal Revenue Service. “Schedule C: Profit or Loss from Business,” Page 1. Internal Revenue Service. “2022 Instructions .

]]>